Private Client Real Estate VIP Access

By Invitation Only

This is a private real estate network dedicated to keeping our clients and community partners connected to our dynamic real estate market. We do this via our VIP email series that is centered around the best real estate deals, investor opportunities and market insights.

Invest Well, Live Well.

Join our VIP Program

Your are invited to join our private real estate VIP network. This is a by-invitation program for our private customers and community partners featuring key real estate centric information such as off-market deals, investor opportunities, market analysis, home buyer search programs and our curated "deal of the week" series featuring real estate deals from time to time.

Deal of the Week

Scrubbed and curated snapshots of the real estate market one property at a time to give you the pulse.

Community Highlights

Important community highlights including regulations, government and lifestyle news.

Investor Network

Hand-picked deals for first-time investors and seasoned investors alike.

Active Home Buyers

Behind the scenes look at active buyer demand including specific buyer needs and timelines.

Market Analysis

Key leading and lagging indicators of the real estate market and its impact on home values.

Off Market Deals

The inside scoop on homes that are for sale or lease that nobody knows about.

Real Stories, Real Results:

See Why Our Customers Love Working with Us

R. Vejerano

They are very impressive on how they were able to come up for a strategic plan, and to resolve any issues. They are very professional and easy to work with the whole time. I have my faith to me that they would be able to help sell the property immediately and THEY DID IT!! I WAS SOOO HAPPY! I am grateful to work with GREAT people!! I mean GREAT, THEM!!!.

A. Misha

Judy and her team helped my girlfriend and me find a fantastic apartment when we moved to Miami from NYC. Best part, because of Covid, they did this completely virtually, while we were across the country. About four months later, they helped me correct an incorrect bank transfer (mistake on my end), and they did so quickly and effectively. My experience of the team has been that they are professional, knowledgable, and responsive. Recommend without reservation.

Read Our Latest Blogs

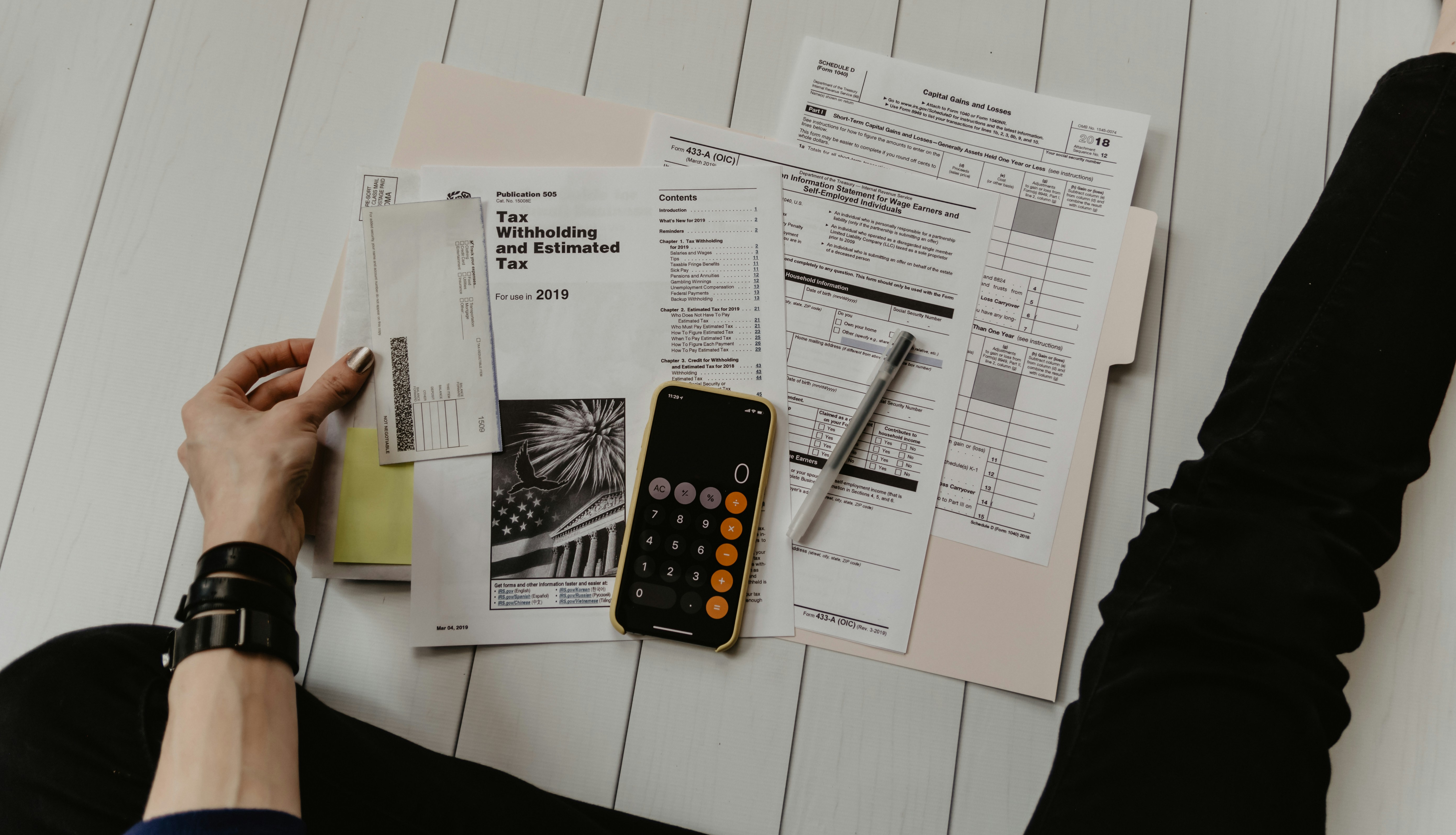

How Banks Determine How Much Home You Can Afford.

How Banks Determine How Much Home You Can Afford: Understanding the Ratios

If you're wondering, "How much house can I afford?" you're not alone. When it comes to approving a mortgage, banks don't rely solely on your credit score—they have specific financial criteria to assess how much home you can comfortably buy. Two key ratios guide this decision: the housing expense ratio (front-end ratio) and the debt-to-income ratio (back-end ratio). Let's break down what these terms mean and how they help determine your ideal home budget.

Housing Expense Ratio (Front-End Ratio):

This ratio shows how much of your gross monthly income should go toward your housing expenses. Housing costs include your mortgage payment, property taxes, and homeowners insurance. Lenders generally recommend that these costs shouldn't exceed 28% of your gross monthly income.Example:

Imagine your annual household income is $100,000. Your gross monthly income would be about $8,333. The bank will calculate that your monthly housing expenses should ideally be no more than $2,333 (28% of $8,333). This guideline ensures you can handle your mortgage and related costs without putting undue stress on your finances.

Debt-to-Income Ratio (Back-End Ratio):

The back-end ratio gives a broader view of your monthly financial obligations. It includes your proposed mortgage payment along with any other recurring debts, such as car loans, student loans, and credit card payments. Banks typically recommend that your total monthly debt payments shouldn't exceed 36% of your gross monthly income.Example:

Using the same gross monthly income of $8,333, lenders will advise that your total monthly debt payments shouldn't surpass $3,000 (36% of $8,333). So, if your non-housing debts add up to $1,000 per month, your maximum allowable monthly mortgage payment would be $2,000.

Finding Your Home Budget:

Banks will use these ratios to help establish the upper limits of your affordability range. By staying within these guidelines, you can ensure that you won't overextend yourself financially while enjoying your new home.

Understanding these ratios is crucial when planning your home search, helping you set realistic expectations and feel empowered as you navigate the homebuying process. Ultimately, it's about finding that sweet spot where your dream home and a comfortable budget meet.

Ready to take the next step toward finding your dream home? Let us guide you through the homebuying process with personalized advice and expert support. Whether you're just starting to explore your options or you're ready to make an offer, we're here to help you every step of the way.

Contact us today to schedule a free consultation, and let's make your homeownership dreams a reality!